Decoding the Wayne County, PA Tax Map: A Complete Information for Residents and Property Homeowners

Associated Articles: Decoding the Wayne County, PA Tax Map: A Complete Information for Residents and Property Homeowners

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Wayne County, PA Tax Map: A Complete Information for Residents and Property Homeowners. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the Wayne County, PA Tax Map: A Complete Information for Residents and Property Homeowners

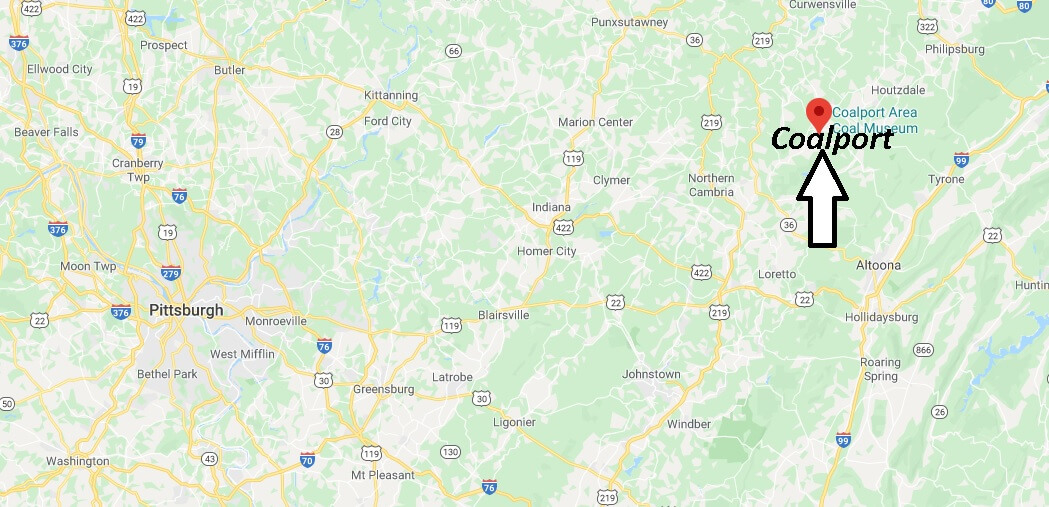

Wayne County, Pennsylvania, a picturesque area nestled within the Pocono Mountains, boasts a wealthy historical past and beautiful pure magnificence. Understanding the county’s tax system, nonetheless, could be a problem for residents and property homeowners. This text serves as a complete information to navigating the intricacies of the Wayne County tax map, explaining its goal, entry and interpret it, and its significance in numerous facets of property possession and county governance.

The Objective of the Wayne County Tax Map:

The Wayne County tax map is an important instrument for environment friendly property tax evaluation and assortment. It is a detailed geographical illustration of the county, divided into parcels of land, every uniquely recognized with a parcel quantity. This quantity serves as the important thing to accessing essential details about every property, together with:

- Possession: The authorized proprietor(s) of the property are recognized by title and deal with.

- Property Tackle: The official deal with assigned to the property.

- Property Dimension and Boundaries: The precise dimensions and limits of the property are delineated on the map, typically together with measurements and authorized descriptions.

- Land Use: The map signifies how the land is used, reminiscent of residential, industrial, agricultural, or vacant.

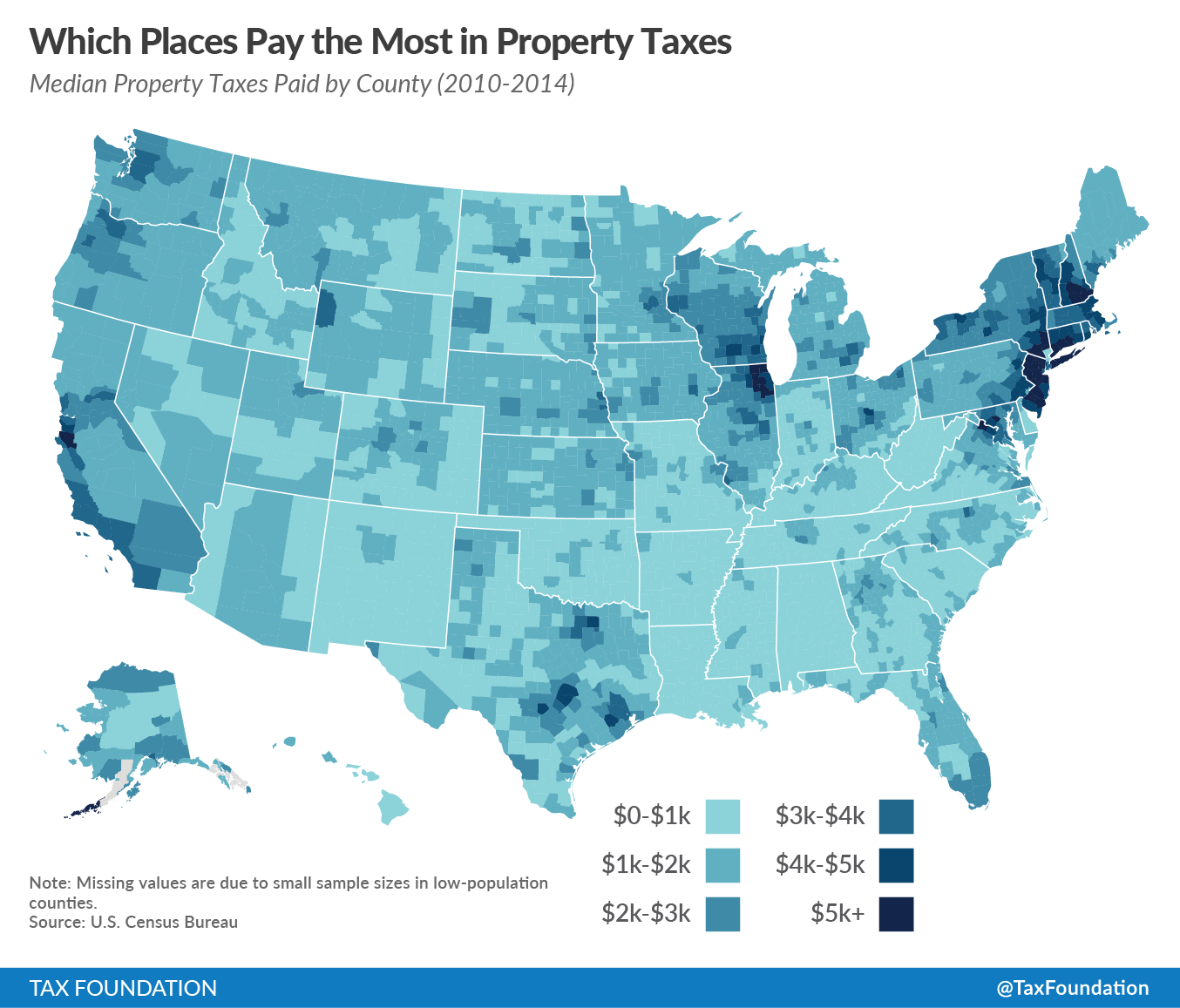

- Evaluation Worth: The assessed worth of the property, used to calculate property taxes, is linked to the parcel quantity.

- Tax Fee: Whereas circuitously on the map itself, the tax price is utilized to the assessed worth to find out the annual property tax legal responsibility.

Past tax evaluation, the tax map performs an important position in:

- Emergency Companies: First responders make the most of the map to shortly find properties throughout emergencies.

- Planning and Zoning: The map assists in land use planning, zoning laws, and growth initiatives.

- Actual Property Transactions: Patrons and sellers use the map to confirm property boundaries and particulars throughout actual property transactions.

- Public Works: The county makes use of the map to plan and handle infrastructure initiatives, reminiscent of street development and upkeep.

Accessing the Wayne County Tax Map:

Accessing the Wayne County tax map is usually simple, though the particular strategies and availability of on-line assets could fluctuate. The first supply of knowledge is normally the Wayne County Assessor’s Workplace. Their web site is usually one of the best place to begin, typically offering:

- On-line Map Viewer: Many counties now provide interactive on-line map viewers. These viewers permit customers to look by deal with, parcel quantity, or proprietor title. The viewer normally shows the parcel boundaries, property data, and probably aerial imagery.

- GIS Information Downloads: Some assessors’ places of work provide downloadable GIS (Geographic Info System) knowledge. This knowledge can be utilized with GIS software program for extra superior evaluation and mapping.

- Bodily Maps: Whereas on-line entry is more and more widespread, it is advisable to test if bodily copies of the tax map or sections of it can be found for assessment on the Assessor’s Workplace. Appointments could also be essential.

Decoding the Wayne County Tax Map:

The Wayne County tax map is a fancy doc, requiring understanding of a number of key parts:

- Parcel Numbers: These distinctive identifiers are essential for accessing all associated property data. They’re normally prominently displayed on the map.

- Scale and Legend: Pay shut consideration to the map’s scale, indicating the connection between the map’s dimensions and precise floor distances. The legend explains the symbols and colours used on the map, representing completely different land makes use of, options, and property boundaries.

- Boundary Traces: Property boundaries are exactly outlined on the map, typically with measurements and authorized descriptions. Disputes relating to boundaries ought to be addressed by authorized channels {and professional} surveys.

- Adjoining Properties: Understanding the connection between your property and neighboring parcels might be vital for numerous causes, together with easements, shared boundaries, and potential growth impacts.

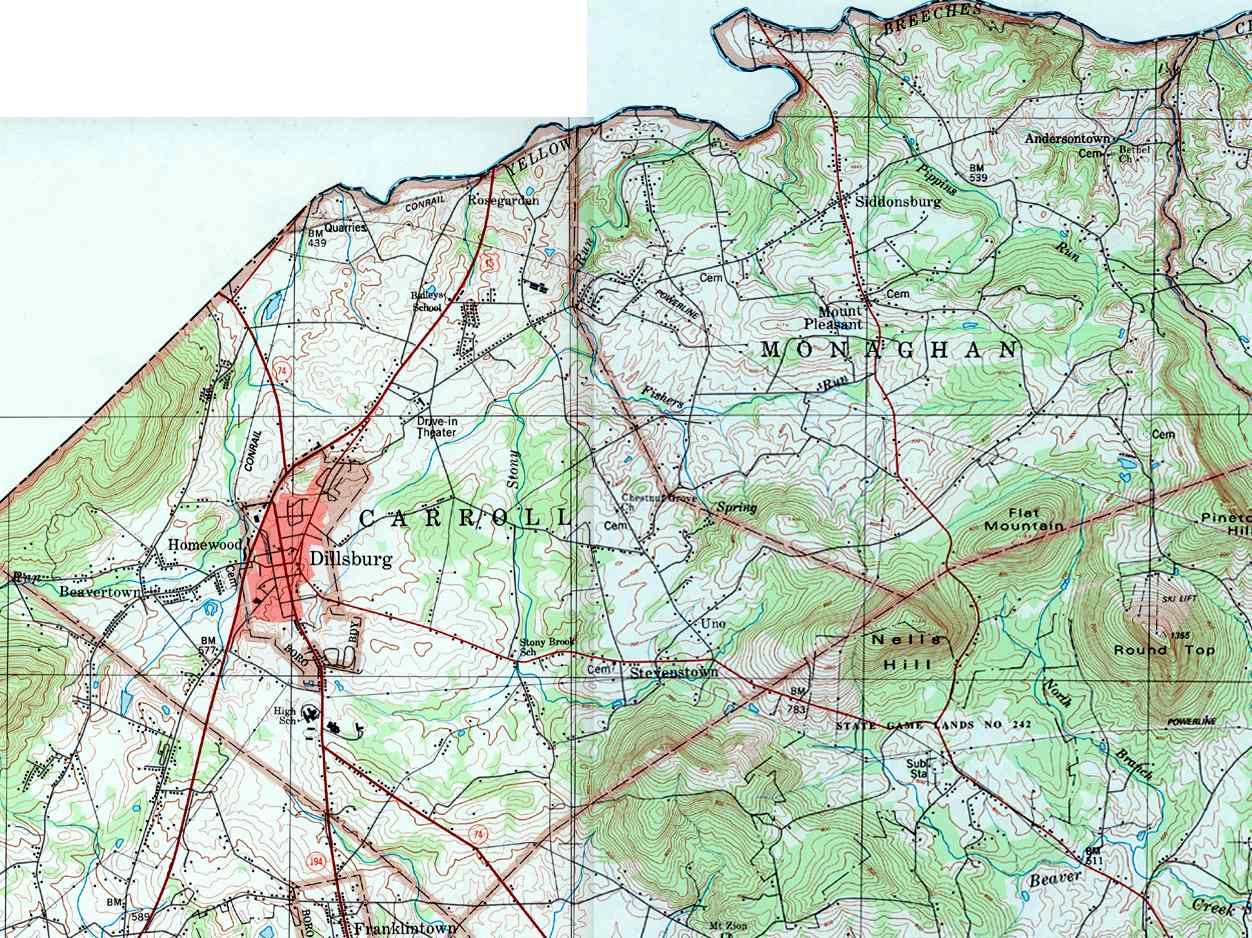

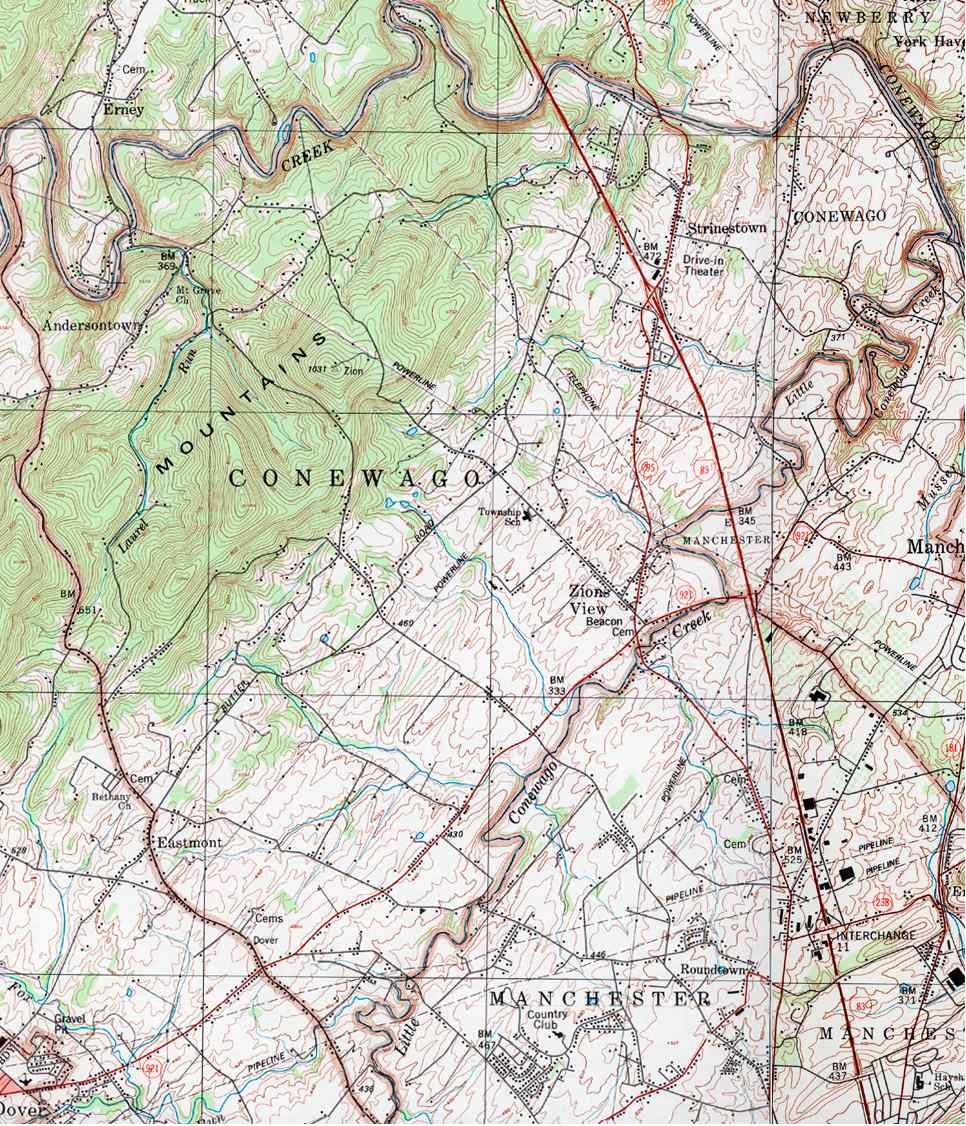

- Topographical Options: The map could embody topographical options like rivers, streams, roads, and elevation adjustments, which may affect property worth and utilization.

Utilizing the Tax Map for Property Tax Calculations:

Whereas the tax map itself would not instantly present the property tax quantity, it offers the important data wanted to calculate it:

- Determine the Parcel Quantity: Find your property on the map and word its parcel quantity.

- Entry the Evaluation Info: Use the parcel quantity to entry the assessed worth of your property by the Assessor’s Workplace web site or data.

- Decide the Tax Fee: The tax price is about yearly by the county authorities and is normally out there on the Assessor’s Workplace web site or by the county treasurer’s workplace.

- Calculate the Tax: Multiply the assessed worth by the tax price to find out your annual property tax legal responsibility.

Challenges and Issues:

Whereas the Wayne County tax map is a invaluable useful resource, it is essential to concentrate on potential challenges:

- Map Accuracy: Whereas efforts are made to keep up accuracy, errors can happen. Discrepancies ought to be reported to the Assessor’s Workplace.

- Information Updates: Tax maps are periodically up to date, however there could also be a time lag between adjustments on the bottom and updates on the map.

- Authorized Descriptions: Understanding authorized descriptions, typically included with parcel data, requires some familiarity with surveying and authorized terminology.

- On-line Accessibility: Not all counties have equally sturdy on-line entry to tax map knowledge. Some could require in-person visits or requests for particular data.

Conclusion:

The Wayne County tax map is a elementary instrument for understanding property possession, assessing property values, and managing numerous facets of county governance. By understanding its goal, accessing its assets, and decoding its data successfully, residents and property homeowners can navigate the complexities of the county’s tax system and make knowledgeable selections relating to their properties. Often checking for updates and using the assets supplied by the Wayne County Assessor’s Workplace is essential for staying knowledgeable and guaranteeing correct property data. In case of any ambiguities or discrepancies, looking for skilled help from a surveyor or authorized skilled is very advisable. This complete understanding of the tax map empowers property homeowners to actively take part of their group and successfully handle their property-related tasks.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the Wayne County, PA Tax Map: A Complete Information for Residents and Property Homeowners. We hope you discover this text informative and useful. See you in our subsequent article!