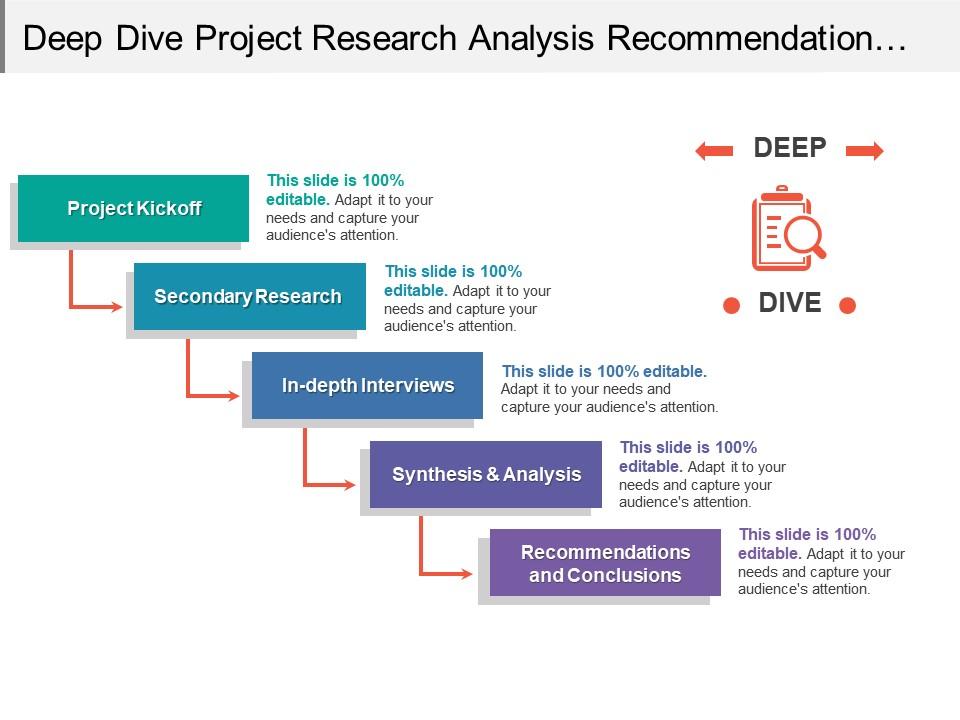

Mapping the Monetary Panorama: A Deep Dive into Banking Maps and Their Significance

Associated Articles: Mapping the Monetary Panorama: A Deep Dive into Banking Maps and Their Significance

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Mapping the Monetary Panorama: A Deep Dive into Banking Maps and Their Significance. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Mapping the Monetary Panorama: A Deep Dive into Banking Maps and Their Significance

The world of finance, as soon as a realm of hushed whispers and secretive transactions, is more and more changing into clear and accessible. An important ingredient driving this shift is the rise of banking maps, refined visualizations that characterize the geographical distribution of economic establishments and their actions. These maps aren’t simply static representations; they’re dynamic instruments providing insights into market saturation, aggressive landscapes, underserved areas, and the general well being of the monetary ecosystem. This text delves into the multifaceted world of banking maps, exploring their varied sorts, functions, knowledge sources, limitations, and future implications.

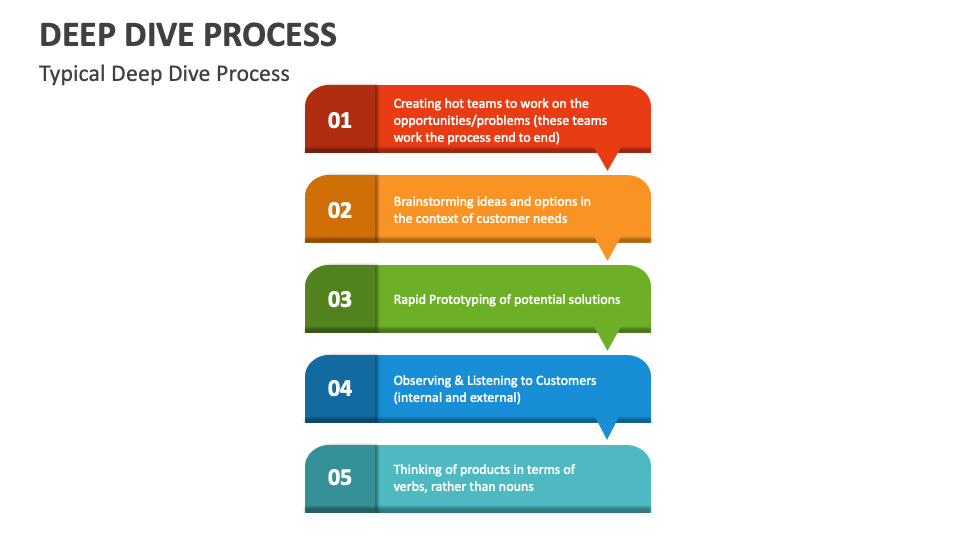

Varieties of Banking Maps and Their Functions:

Banking maps are removed from monolithic. Their complexity and performance range considerably relying on their meant objective and the extent of element they incorporate. Broadly, we are able to categorize them into a number of sorts:

-

Department Location Maps: These are essentially the most primary type, merely showcasing the geographical distribution of financial institution branches, ATMs, and different bodily places. These maps are readily accessible to the general public, usually built-in into financial institution web sites or cellular apps. Their main utility is buyer comfort, permitting customers to simply find the closest department or ATM. Nonetheless, additionally they supply a rudimentary understanding of market penetration and potential areas for enlargement for banking establishments.

-

Market Share Maps: These maps transcend easy location knowledge, overlaying department density with market share data for particular person banks or banking teams. This enables for a extra nuanced understanding of competitors inside particular geographic areas. As an example, a market share map would possibly spotlight areas the place a specific financial institution dominates, areas with intense competitors, or underserved markets with potential for progress. Such maps are invaluable for strategic planning, aggressive evaluation, and figuring out goal markets.

-

Monetary Inclusion Maps: These maps concentrate on figuring out areas with restricted entry to monetary providers. They usually incorporate knowledge on financial institution department density, ATM availability, cellular banking penetration, and monetary literacy charges. These maps are essential for policymakers and improvement organizations searching for to advertise monetary inclusion and cut back the monetary exclusion hole. They will inform the allocation of assets, the design of focused monetary inclusion applications, and the event of revolutionary monetary options for underserved populations.

-

Danger Evaluation Maps: These maps incorporate quite a lot of knowledge factors past geographical location, together with credit score danger, fraud danger, and operational danger. They could overlay crime statistics, socioeconomic indicators, and environmental elements to create a complete danger profile for various areas. These maps are primarily utilized by banks and monetary establishments for inside danger administration, credit score scoring, and fraud prevention. They’re essential for knowledgeable decision-making relating to lending, funding, and operational methods.

-

Regulatory Compliance Maps: These maps are used to make sure compliance with varied banking rules. They could monitor the situation of branches in relation to particular regulatory zones, or map the distribution of economic actions to make sure compliance with anti-money laundering (AML) rules. These maps are important for sustaining regulatory compliance and mitigating authorized and monetary dangers.

-

Buyer Segmentation Maps: These maps transcend easy demographics and overlay buyer knowledge with geographical location to create detailed buyer segments. This enables banks to focus on particular advertising campaigns, tailor product choices, and optimize department operations primarily based on buyer wants and preferences in numerous areas.

Information Sources for Banking Maps:

The accuracy and richness of banking maps rely closely on the standard and completeness of the underlying knowledge. A number of sources contribute to this knowledge:

-

Financial institution Department Databases: Banks themselves preserve in depth databases of their department places, operational hours, and providers provided. It is a main supply of knowledge for a lot of banking maps.

-

OpenStreetMap (OSM): This collaborative, open-source map of the world supplies a wealth of geographical knowledge, together with the situation of varied factors of curiosity, which can be utilized to establish financial institution branches and ATMs.

-

Authorities Companies: Authorities companies usually acquire knowledge on monetary establishments, together with licensing data, monetary efficiency, and geographical distribution.

-

Industrial Information Suppliers: A number of industrial firms focus on amassing and aggregating monetary knowledge, usually offering detailed datasets that can be utilized to create refined banking maps.

-

Cellular Machine Information: Anonymized cellular system knowledge can present insights into the motion of people and their interplay with monetary establishments, providing a priceless supplementary knowledge supply.

Limitations of Banking Maps:

Whereas banking maps supply priceless insights, they aren’t with out limitations:

-

Information Accuracy and Completeness: The accuracy of banking maps relies upon completely on the accuracy of the underlying knowledge. Incomplete or inaccurate knowledge can result in deceptive conclusions.

-

Information Bias: The information used to create banking maps might replicate present biases, resulting in skewed representations of the monetary panorama.

-

Dynamic Nature of the Monetary Panorama: The monetary panorama is continually evolving, with banks opening and shutting branches, merging, and increasing their operations. Banking maps should be frequently up to date to replicate these modifications.

-

Privateness Considerations: Using buyer knowledge to create banking maps raises privateness considerations that should be fastidiously addressed. Anonymization and aggregation methods are essential to guard buyer privateness.

Future Implications of Banking Maps:

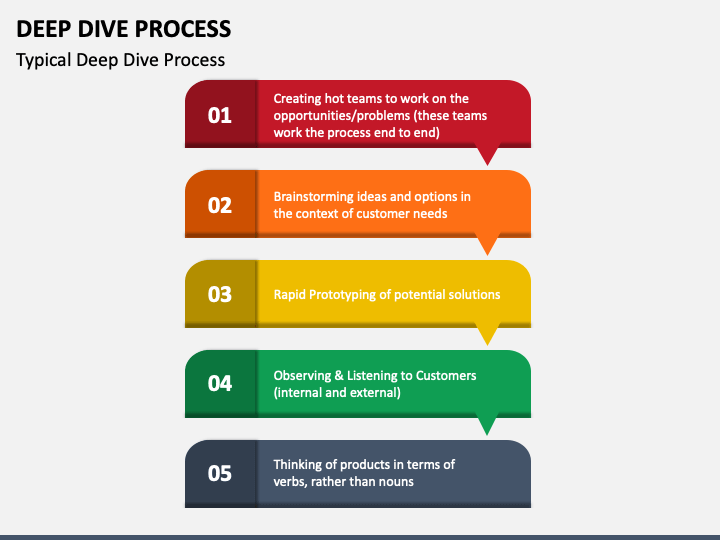

The way forward for banking maps is vibrant, pushed by developments in knowledge analytics, GIS expertise, and machine studying. We are able to count on to see:

-

Elevated Granularity and Accuracy: Improved knowledge assortment and analytical methods will result in extra granular and correct banking maps.

-

Integration with Different Information Sources: Banking maps will more and more combine with different knowledge sources, similar to socioeconomic knowledge, environmental knowledge, and real-time transaction knowledge, to supply a extra holistic view of the monetary panorama.

-

Predictive Analytics: Machine studying methods might be used to create predictive fashions primarily based on banking map knowledge, permitting banks to anticipate future developments and make extra knowledgeable selections.

-

Interactive and Dynamic Maps: Banking maps will turn out to be extra interactive and dynamic, permitting customers to discover completely different knowledge layers, customise their views, and work together with the info in real-time.

-

Enhanced Visualization Strategies: New visualization methods might be developed to make banking maps extra intuitive and simpler to grasp.

Conclusion:

Banking maps are evolving from easy representations of department places to highly effective analytical instruments providing priceless insights into the monetary panorama. Their functions span throughout varied sectors, from customer support and strategic planning to danger administration and regulatory compliance. Whereas limitations exist relating to knowledge accuracy and privateness, the potential advantages of those maps are important. As knowledge assortment strategies enhance and analytical methods advance, banking maps will play an more and more necessary function in shaping the way forward for the monetary trade. Their capability to visualise complicated monetary knowledge, establish underserved markets, and inform strategic decision-making will proceed to make them an indispensable device for banks, policymakers, and researchers alike. The way forward for finance is being mapped, one insightful visualization at a time.

Closure

Thus, we hope this text has offered priceless insights into Mapping the Monetary Panorama: A Deep Dive into Banking Maps and Their Significance. We respect your consideration to our article. See you in our subsequent article!